Behavioral portfolio theory arises from a psychological account of security, potential, and aspiration. Having a variant perception can be seen benignly as simply being contrarian. ‘A person who is conscious selectively perceives. ‘People admire that quiet charm, perceiving great depth and understanding behind that gentle manner.’. This repeatable framework identifies opportunities in all asset classes. Mood is assessed by asking patients how they are feeling, thus a patient’s mood might. To use a meteorological analogy: affect is the weather, whereas mood is the climate. Affect is the emotional state prevailing at the time of the examination.

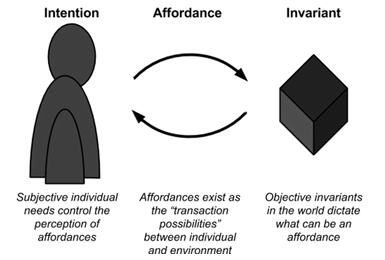

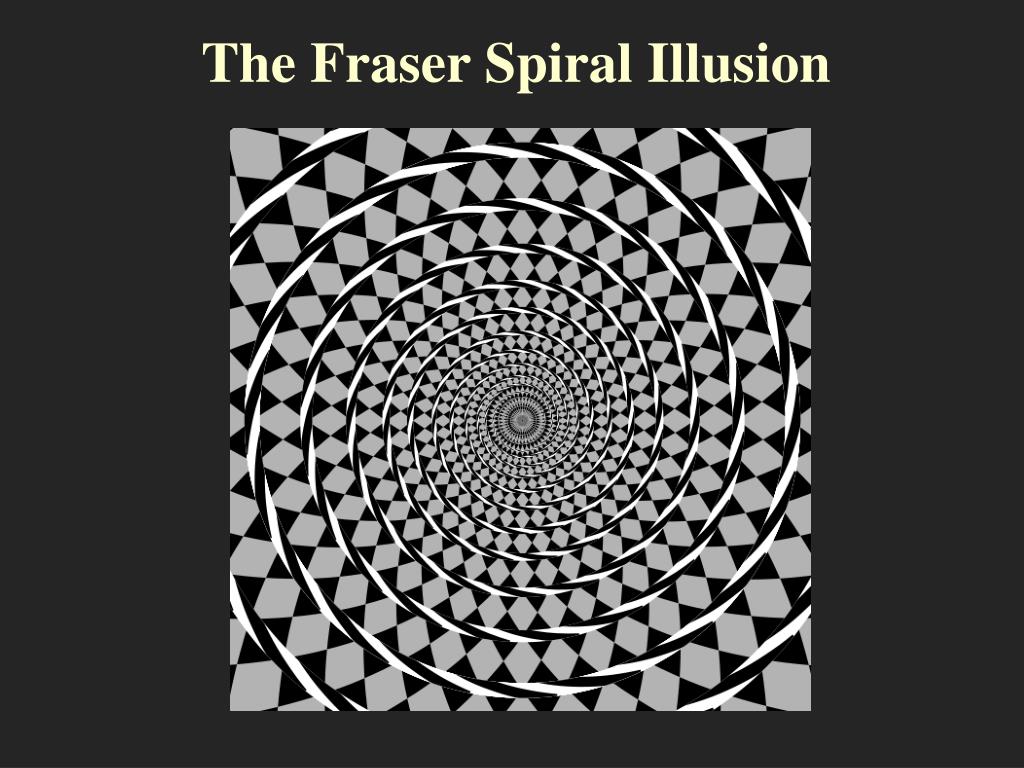

‘Her ability to understand, to perceive the nature of the truth was what was being tested.’. Variant Perception uses leading economic and liquidity indicators to anticipate market turning points. Mood is the patient’s sustained, subjectively experienced emotional state over a period of time. Prospect theory has questioned the cogency of the efficient capital markets hypothesis. 1 Become aware or conscious of (something) come to realize or understand. Risk aversion and life-cycle theories of consumption provide possible solutions to the equity premium puzzle, an iconic financial mystery. Whether hedging against intertemporal changes in their ability to bear risk or climbing a psychological hierarchy of needs, investors arrange their portfolios and financial affairs according to emotions and perceptions.

It has made a new high, broken out of resistance and has done so on increasing volume. Across all time points there was a positive relationship between risk perception and reported health protective behaviours, meaning higher levels of risk. I could make the compelling case that the stock has broken out. About Our Story Our Data Team Careers Scholarship Program Case Studies Data Compliances. of a variant perception relative to the market focus on quarterly. Whenever, you take a position in a given instrument you are by definition doing something that is different from someone else in the same circumstances. Get Variant Perception companys verified contact number +1732, web address, revenue, total contacts 8, industry Financial Services and location at Adapt.io. Assets and portfolios are imbued with “affect.” Positive and negative emotions warp investment decisions. While one can argue with the precise definition of retail sales and whether the. Behavioral accounting undermines the rational premises of mathematical finance. Gaps in perception and behavioral departures from rationality spur momentum, irrational exuberance, and speculative bubbles. This book explains how investor behavior, from mental accounting to the combustible interplay of hope and fear, affects financial economics. The transformation of portfolio theory begins with the identification of anomalies. One of the key traits a successful value investor must have is a variant perception.

0 kommentar(er)

0 kommentar(er)